After multiple trips abroad and lots of money down the drain, we finally found the perfect solution that allows travelers to completely avoid exchanging money: the Charles Schwab ATM card. Most people think there’s nothing wrong with exchanging money, but what those exchange places aren’t telling you is that you lose money every time! Here’s how to avoid that.

You see them the second you get off the plane: Money Exchange Here! No Commission! Get (Insert the Country You Are In) Money Here!

So what’s the problem? If they aren’t getting commission and you aren’t paying any extra?

Pay attention to the exchange rate that they have posted. They have a “buy” rate and a “sell” rate.” This means that no matter what you do, when you exchange money you aren’t getting the exact market value for your money.

However, your bank will give you a better conversion rate than a Money Exchange place will.

So what should you do instead?

Apply for a Charles Schwab ATM Card (debit card)

It’s basically too good to be true. Charles Schwab allows you to take money out ANYWHERE and from ANY ATM without paying any fees.

Step One: Open an Account

Go to Schwab.com and Select Open an Account

Step Two: Choose Your Account

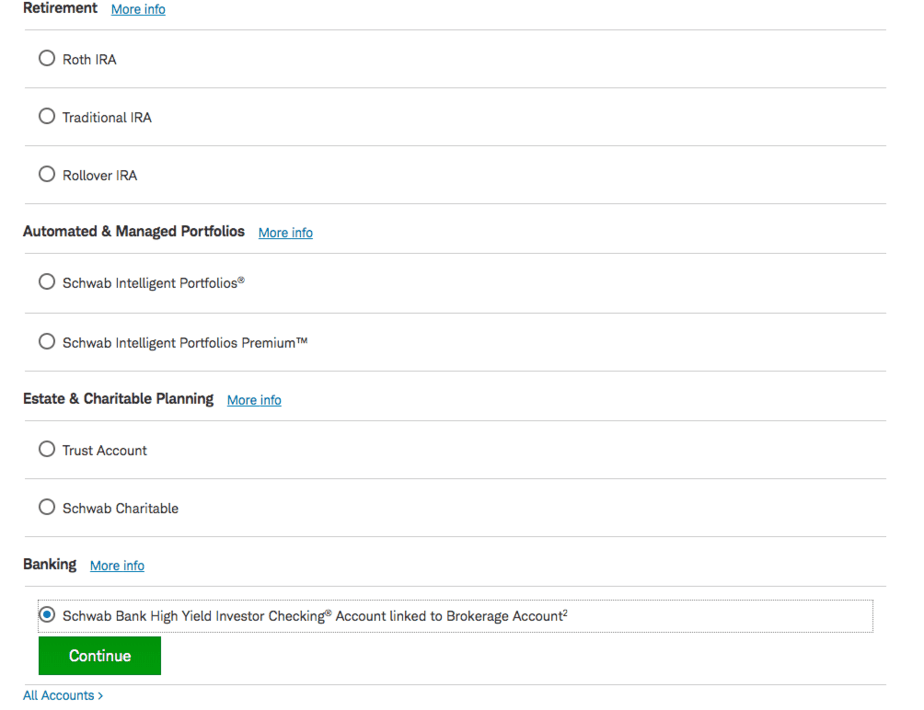

Choose the option to apply for “Schwab Bank High Yield Investor Checking® Account linked to Brokerage Account2“

When you open an account with Charles Schwab, you are actually opening an Investor Checking account and a Brokerage account.

You will only be using the checking account, but it is required to open a Brokerage account as well at no cost at all.

Step 3: Use Your Current Account to Verify

In order to open an account, you will have to verify an existing checking account (the one which you use normally). You will use that original checking account to fund your Charles Schwab ATM account.

This usually happens by them depositing two small amounts (called Trial Deposits) onto your external account and then you will need to type in the amounts correctly to verify.

This is not unique to Charles Schwab, we use this verification system between all of our online banking accounts in order to transfer money between them.

Charles Schwab: The ATM Card with NO ATM Fees

Now that you have an account and have funded it, the fun part starts! You never have to worry about ATM fees ever again! Hallelujah! Such a huge weight lifted off a traveler’s shoulders.

How it Works

When you take money out of an ATM, it will say “You will be charged this much for using this ATM, do you agree?” Everyone else will be debating whether that transaction is worth it or trying to convert the fee into a number they understand, but with Charles Schwab, you don’t have to worry about that at all!

I sound like a commercial, but this has been a serious lifesaver for us. At the end of the month, all of the “fees” that you were charged are put back into your account. So basically “refunded.”

And there’s no limit to how many fees can get refunded or an amount that is too high! It’s awesome!

Why this saves you time & money

When we first moved abroad, we were using Wells Fargo which was a total joke for traveling abroad. It charges a fee for taking money out of a foreign ATM as well as a fee for converting the currency for you (how ridiculous is that?) and on top of all that, you get charged a fee from the ATM itself.

We would have to carefully calculate how much we needed to get out that month since it cost us about $15 each time we took money out of the ATM. There’s no room for error there.

Although our lives have become so much simpler since switching, there are a few things you need to keep in mind with Charles Schwab…

How to Manage Your ATM Transactions Abroad with Charles Schwab

Worried about getting out too much money or too little money? It takes a little practice, but since there is not a limit to how much you can get out or a fee when taking out money, you don’t have to stress as much anymore.

For example, say you have 1 week in Bali (if so, definitely check out this itinerary for Uluwatu!) Most places in Bali do not accept credit cards, so you can safely assume that you are going to need to get out a little more in cash. However, in most places, there are also a lot of ATMs.

So how much should you get out? If you know that there will be more ATMs available to you, then anywhere from $50-$150 is a good amount.

It takes a while to get out of the old ATM mindset of needing to get out as much as possible so that you don’t have to pay a fee every time, but less is more in this case!

Nothing is holding you back from getting more money out later.

Avoiding Scams

Even though we don’t live in Bali anymore, I still try to keep up with what is going on in the number #1 tourist hot spot in Asia. One of the most prevalent scams these days involves illegal money exchanges.

They will exchange the money for you for the exchange rate that they have listed and have you count it. Then they will distract you while they offer to count it again, but this time they take some of the money out.

Another thing is credit card skimming. This is when an ATM machine is corrupt and gets your card information (I’m not quite sure how this works). This has never happened to us, but we are always prepared.

You should never keep more than a few hundred dollars in your Charles Schwab account so that if your card does get skimmed, you aren’t losing all of your money.

Also, never pay for anything abroad (or online) with a debit card. If you pay with a debit card, your actual money is stolen and it is very hard to get back.

When you pay with a credit card, you are paying with credit, which is easy to fix when there is fraudulent activity on your card. You are protecting your actual money!

Plus, if you are paying with a debit card, you are missing out on opportunities to get points and miles using travel credit cards! But we’ll talk about that in another post!

4-Day Rule

One of the only downsides to this card is that it takes 4 full business days for the money to be transferred from your bank account into your Charles Schwab account.

Why would this be a problem? If you are a procrastinator like me, sometimes you can forget until the last minute that you don’t have enough money in your ATM account.

I send our direct deposit from VIPKid straight to our Wells Fargo account, then transfer only a bit of it onto our Charles Schwab travel debit card.

This means, there are times when we have to wait 4 whole days before the money that we transferred can be taken out.

For emergencies like this, it’s always good to keep another account open. We keep some money in our Wells Fargo Checking Account for days like that, but it always puts me in a bad mood having to waste money with ATM fees!

What If You Have Extra Money at the End of the Trip?

If you are really only getting out what you need, you shouldn’t have much left over. But if you do there are a few things you can do.

Treat yo’ self!

First, you could treat yourself! Assuming that you budgeted well and you only have a little left (like $10-$20) you could make your last meal a really nice one!

Collect it

You could keep it. Jake has been collecting money from around the world since he was a kid. Now whenever we go back to his house, we take all our extra money and put it in his collection.

Then, if we know that we will be going to Europe, Thailand, or any country we have already been to, we check his collection to see if there are doubles of anything. If we have extra money, we take it with us on that trip!

Find a friend who loves to travel

If you don’t ever plan on returning to the country that you have money from and you don’t want to keep the money as a souvenir, there’s a third option!

Find a friend who is planning to travel there or even try to find someone before you leave the country itself. When you are doing a money exchange with a friend, all you need to do is Google the exact conversion rate that day and exchange it exactly.

Your friend would get the cash for their trip and you wouldn’t have lost a penny! (Unless the currency changed in value while you were on your trip! Which happened to us in Turkey!)

Which is one more reason you might want to consider keeping the money. When we first took money out in Turkey, the dollar was a lot stronger.

By the time we left, it had gone down so much that our rent went up by about $40! But we had gotten money out when we first moved there so it didn’t affect us.

When I first started traveling, this was the first advice a seasoned traveler gave me: “Never exchange money at the end of your trip!” And we haven’t done it once since living abroad!

Last Resort

If you’ve exhausted all other ways, your last resort would be to find a reputable money exchange with no commission. I’ve only done this in emergencies like being stranded in a country with no way to get money out of an ATM, so we had to exchange the only cash we had.

Treat it like that! Keep your money, you earned it! And open a Charles Schwab checking account so you can travel more (every dollar counts!)

Looking for more money-saving tips?

Also, don’t forget to pin this tip for later! (:

Dayna Brockbank is a travel and language-learning blogger who has lived around the world but has now settled in Nice, France. She speaks 3 languages at varying levels of fluency: Spanish, Italian, and French, and graduated with a Bachelor’s in Spanish Education. She and her husband focus on making travel part of life by living cheaply and traveling on a budget.

Bri

Wednesday 22nd of January 2020

Hi I was going to be traveling in Guatemala staying there for about 8-10 months and I need a traveling bank so I don’t get charged any fees I don’t know if I should get the Charles schwab or not I heard that if your out of the country more than 6 months and don’t purchase anything in USA they close your account ?? Also how do you transfer money from your bank account in US to the traveling one ?

admin

Sunday 26th of January 2020

Hey! Charles Schwab is perfect for that. As far as I know, they don't close your account. I have had a Charles Schwab card for a few years and I don't think I've ever used it in the USA. We keep the main account with Wells Fargo (where we get our VIPKID payments) and then whenever we know that we'll need money from an ATM, we direct transfer it to our Charles Schwab. We don't like to keep a ton of money in Charles Schwab since it's still possible to get money stolen from there. But you have to be careful too because it takes 4 days for the transfer to reach your account! Good luck and have a great trip to Guatemala!